Sunday, October 30, 2011

DEGENFL PROPS WEEK 8

need that, rest is terrible bloody mess

"CLE Browns @ SF 49ers W

(Longest Field Goal Made) Over 43.5 Yards"

"Rashard Mendenhall (PIT Steelers) Rush Yards

(Player Performances) Over 62.5"W

"Joe Flacco (BAL Ravens) Pass Yards

(Player Performances) Over 255.5"W

"Maurice Jones-Drew (JAX Jaguars) Rush Yards

(Player Performances) Over 84.5" L

"Cam Newton (CAR Panthers) Pass Yards

(Player Performances) Over 275.5"W

DEGENFL DEBACLISATION WEEK 8

giant suck

"NFL, American Football L

Indianapolis Colts 30-October-2011 10:00 AM PST

Handicap +9 for Game" ANY GIVEN SUNDAY, hey gophers beat Iowa yesterday!

"NFL, American Football PUSH

Houston Texans 30-October-2011 10:00 AM PST

Handicap -10 for Game"

"NFL, American Football W

Minnesota Vikings 30-October-2011 10:00 AM PST

Handicap +3 for Game"

"NFL, American Football L

New Orleans Saints 30-October-2011 10:00 AM PST

Handicap -13.5 for Game"

"NFL, American Football L

Baltimore Ravens 30-October-2011 10:00 AM PST

Handicap -12 for Game"

"NFL, American Football L

New York Giants 30-October-2011 10:00 AM PST

Handicap -9.5 for Game"

"NFL, American Football W

Buffalo Bills 30-October-2011 1:05 PM PST

Handicap -4.5 for Game"

"NFL, American Football W

Detroit Lions 30-October-2011 1:05 PM PST

Handicap -3 for Game"

"NFL, American Football L

New England Patriots 30-October-2011 1:15 PM PST

Handicap -3 for Game"

"NFL, American Football W

San Francisco 49ers 30-October-2011 1:15 PM PST

Handicap -9 for Game"

"NFL, American Football L

Seattle Seahawks 30-October-2011 1:15 PM PST

Handicap +1 for Game"

"NFL, American Football W

Philadelphia Eagles 30-October-2011 5:30 PM PST

Handicap -3 for Game"

"NFL, American Football L

San Diego Chargers 31-October-2011 5:35 PM PST

Handicap -3 for Game"

from yurope this morning, excitment abounds and losers mount?

Indian Grand Prix

105*Race Matchups

Jerome d'Ambrosio vs Timo Glock

515. Jerome d'Ambrosio"W

"Indian Grand Prix - Lewis Hamilton vs Jenson Button

(To Win Match) Jenson Button"W

"Belgium - Pro League, Soccer

Anderlecht/Lierse 30-October-2011 9:59 AM PST

Total Goals Over 3 for Game"

"Germany - Bundesliga, Soccer W

Köln/Augsburg 30-October-2011 7:30 AM PST

Total Goals Over 2.5 for Game"

"Holland - Eredivisie, Soccer W

NEC Nijmegen/FC Utrecht 30-October-2011 6:29 AM PST

Total Goals Over 2.5 for Game"

"Italy - Serie A, Soccer L

Udinese/Palermo 30-October-2011 7:00 AM PST

Total Goals Over 2.5 for Game"

"Hamburg v KaiserslauternL

(Asian Total Corners) Over 10.0"

"Hamburg v KaiserslauternW

(Time of First Card) Card before 31:00"

"France - Ligue 1, SoccerL

Toulouse/Rennes 30-October-2011 8:59 AM PST

Total Goals Over 2 for Game"

Saturday, October 29, 2011

the government banksters are fucking you under!

Kidball episode 6?

"NCAA, American Football L

Clemson 29-October-2011 5:00 PM PST

Handicap -3.5 for Game"

"NCAA, American Football L

Iowa 29-October-2011 12:30 PM PST

Handicap -15.5 for Game"

"NCAA, American Football L

Michigan State 29-October-2011 9:00 AM PST

Handicap +4 for Game"

"NCAA, American Football L

Rutgers 29-October-2011 12:30 PM PST

Handicap +6.5 for Game"

"NCAA, American Football W

Vanderbilt 29-October-2011 9:20 AM PST

Handicap +8.5 for Game"

"NCAA, American Football L

Navy 29-October-2011 12:30 PM PST

Handicap +22 for Game"

"NCAA, American Football W

Georgia 29-October-2011 12:30 PM PST

Handicap -3 for Game"

"NCAA, American Football W

UCLA 29-October-2011 4:00 PM PST

Handicap +4.5 for Game"

"NCAA, American Football L

Oregon 29-October-2011 12:00 PM PST

Handicap -34.5 for Game"

"NCAA, American Football L

Wisconsin 29-October-2011 5:00 PM PST

Handicap -7.5 for Game"

another saturday in paradise, Futbol style!!

"Belgium - Pro League, Soccer L

RAEC Mons/KAA Gent 29-October-2011 10:59 AM PST

Total Goals Over 3 for Game"

"Belgium - Pro League, Soccer L

Lokeren 29-October-2011 10:59 AM PST

Handicap 0 and -0.5 for Game"

"Belgium - Pro League, Soccer L

Mechelen/Westerlo 29-October-2011 10:59 AM PST

Total Goals Over 2.5 for Game"

"Germany - Bundesliga, Soccer W

Borussia Mönchengladbach/Hannover 96 29-October-2011 6:30 AM PST

Total Goals Over 2.5 for Game"

"Germany - Bundesliga, Soccer W

Home Teams (Saturday 6 Matches)/Away Teams (Saturday 6 Matches) 29-October-2011 6:30 AM PST

Total Goals Over 17 for Game"

"Holland - Eredivisie, Soccer L

Excelsior SBV/RKC Waalwijk 29-October-2011 10:44 AM PST

Total Goals Over 2.5 and 3 for Game"

"Holland - Eredivisie, Soccer W

FC Twente Enschede/PSV Eindhoven 29-October-2011 11:44 AM PST

Total Goals Over 2.5 and 3 for Game"

"Holland - Eredivisie, Soccer W

Home Teams (Saturday 4 Matches)/Away Teams (Saturday 4 Matches) 29-October-2011 9:44 AM PST

Total Goals Over 12.5 for Game"

"Italy - Serie A, Soccer W

Roma/AC Milan 29-October-2011 9:00 AM PST

Total Goals Over 2.5 for Game"

"France - Ligue 1, Soccer L

Home Teams (Saturday 7 Matches)/Away Teams (Saturday 7 Matches) 29-October-2011 9:59 AM PST

Total Goals Under 17.5 for Game"

"Wolfsburg v Hertha Berlin

(Time of First Card) Card before 30:00" L

"Bayern Munich v Nurnberg

(Time of First Card) Card before 36:00" W

Friday, October 28, 2011

Go Wash go

BYU 28-October-2011 5:00 PM PST W

Handicap +13 for Game"

"MLB, Baseball

Texas Rangers 28-October-2011 5:05 PM PST L

Money Line for Game

M. Harrison must start C. Carpenter must start"

Why Are Taxpayers Subsidizing Facebook, and the Next Bubble?

Goldman Sachs is investing $450 million of its own money in Facebook, at a valuation that implies the social-networking company is now worth $50 billion. Goldman is also creating a fund that will offer its high-net-worth clients an opportunity to invest in Facebook.

On the face of it, this might seem just like what the financial sector is supposed to be doing – channeling money into productive enterprise. The Securities and Exchange Commission is reportedly looking at the way private investors will be involved, but there are more deeply unsettling factors at work here.

Thursday, October 27, 2011

"If #occupyoakland was in Damascus, U.S. State department would be telling Wolf Blitzer how unacceptable it was to teargas peaceful marchers." @techso

If the 1 percent commits crimes, they aren't even investigated.

But this isn't about envy and entitlement. I can understand the misunderstanding in some ways, but it's just not about that. The people out there in Zucotti Park are there because they have to live by different rules than the 1 percent. It's really that simple. If they default on loans, they lose everything. If the 1 percent defaults, they get government bailouts. If they commit crimes, they go to jail. If the 1 percent commits crimes, they aren't even investigated.

Glenn Greenwald points all the way back to Gerald Ford's pardon of Richard Nixon as evidence that there are two justice systems in this country: One for 99 percent and another for the privileged 1 percent.

Give it back, Thursday night kidball

Miami Florida 27-October-2011 5:00 PM PST L

Handicap -14 for Game"

"NCAA, American Football

Houston U 27-October-2011 5:00 PM PST W

Handicap -28 for Game"

Rahm Emanuel is a cocksucker and a shill for israel.. woop same thing...

VIDEO - Rahm Emanuel On Occupy Chicago Arrests

From Cheyenne, who lives in Chicago and has visited frequently with the protesters:

Rahm is so totally full of shit it's incredible. He follows in the long tradition of Barney Fife, who runs around making sure that each and every nit-picking park ranger regulation is strictly enforced against people exercising their 1st amendment rights. And yet, when Rahm's crony capitalists on Wall Street engage in high-frequency quote-stuffing (which is per se illegal) to loot trillions from the public purse, Rahm "We Must Enforce the Law" Emanuel turns a blind eye and keeps his mouth shut.

Not surprisingly, the invective of the protesters is aimed at Rahm's Wall Street crybaby capitalists, who pay their minions like Rahm to get up like a dancing bear and make videos like the one posted here.

It's just absurd.

Oakland Police Throw Grenade Into Crowd

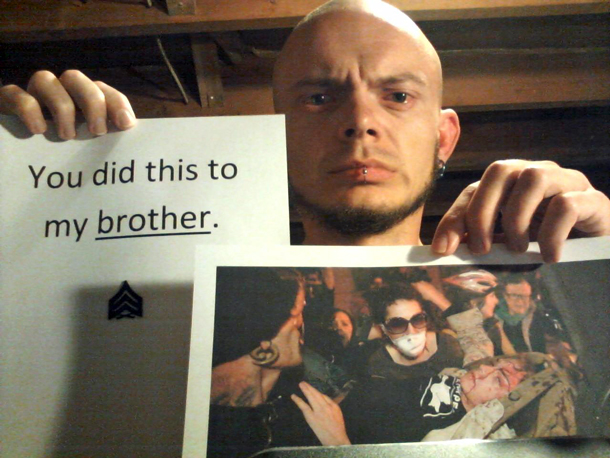

if you don't comment no angel will gets its wings... 0MARINES TO OAKLAND POLICE: 'You Did This To My Brother'

MARINES TO OAKLAND POLICE: 'You Did This To My Brother'

Marines around the world are outraged by the injuries inflicted by police on Scott Olsen at Tuesday's Occupy Oakland protests. Olsen is in a medically-induced coma after getting hit in the head by a police projectile. The photo is taken from the Reddit thread "How I feel, as a United States Marine, about what occurred in Oakland."

In the five hours since the thread went up there have been over 600 comments.

They think the CEO of a company should get paid 10,000 times what the workers get.

They think the CEO of a company should get paid 10,000 times what the workers get.

They think that CEO should pay less taxes than his secretary.

The big problem for them now is 57% of America agrees with OWS.

How long before some Teabagging governor orders the National Guard to open fire?

Scott Olson fought in Iraq and risked all "to protect our way of life,"

for exercising his right to assemble here at home.

Interesting...

Scott Olson fought in Iraq and risked all "to protect our way of life," which includes the right

to peaceably assemble and he got "shot" in the head for daring to take the Constitution seriously...

Also, I've heard some mayors say they had to crack down because they got threatening phone calls.

Trust me - those calls were placed by GOP dirty tricksters like Karl Rove.

I'm sure when Obama finally kills off pot and poker, he'll weigh in on these outrages.

Wednesday, October 26, 2011

Beker van Belgie and a Wednesday kidball

KAA Gent/Club Brugge 26-October-2011 11:45 AM PST W

Total Goals Over 2.5 and 3 for Game"

"NCAA, American Football

Pittsburgh U 26-October-2011 5:00 PM PST W

Handicap -10 for Game"

Sunday, October 23, 2011

bloody sunday part 7?

Props 3-1

total 9-7-1

small losers

"HOU Texans @ TEN Titans

(Longest Field Goal Made) Over 43.5 Yards" L

"BAL Ravens @ JAX Jaguars

(Longest Field Goal Made) Over 43.5 Yards" W

"Adrian Peterson (MIN Vikings) Rush Yards W

(Player Performances) Over 74.5"

"Ben Roethlisberger (PIT Steelers) Pass Yards W

(Player Performances) Over 258.5"

"Marshawn Lynch (SEA Seahawks) Rush Yards DNP

(Player Performances) Over 65.5"

"NFL, American Football

Tampa Bay Buccaneers 23-October-2011 10:00 AM PST L

Handicap +1 for Game"

"NFL, American Football

Carolina Panthers 23-October-2011 10:00 AM PST W

Handicap -1.5 for Game"

"NFL, American Football

San Diego Chargers 23-October-2011 10:00 AM PST L

Handicap +1 for Game"

"NFL, American Football

Cleveland Browns 23-October-2011 10:00 AM PST P

Handicap -3 for Game"

"NFL, American Football

Houston Texans 23-October-2011 10:00 AM PST W

Handicap +3 for Game"

"NFL, American Football

Denver Broncos 23-October-2011 10:00 AM PST

Handicap -1 for Game" W

"NFL, American Football

Detroit Lions 23-October-2011 10:00 AM PST L

Handicap -4 for Game"

"NFL, American Football

Oakland Raiders 23-October-2011 1:05 PM PST L

Handicap -3.5 for Game"

"NFL, American Football

Pittsburgh Steelers 23-October-2011 1:05 PM PST W

Handicap -3.5 for Game"

"NFL, American Football

Dallas Cowboys 23-October-2011 1:15 PM PST W

Handicap -13.5 for Game"

"NFL, American Football

Green Bay Packers 23-October-2011 1:15 PM PST L

Handicap -9.5 for Game"

"NFL, American Football

New Orleans Saints 23-October-2011 5:30 PM PST W

Handicap -13.5 for Game"

"NFL, American Football

Baltimore Ravens 24-October-2011 5:35 PM PST L

Handicap -9 for Game"

Get back on the horse and bet FUTBOL!!

Westerlo/Anderlecht 23-October-2011 5:29 AM PST

Total Goals Over 2.5 for Game"

"Belgium - Pro League, Soccer

Kortrijk/Club Brugge 23-October-2011 8:59 AM PST

Total Goals Over 2.5 for Game"

"Holland - Eredivisie, Soccer

Ajax/Feyenoord 23-October-2011 3:29 AM PST

Total Goals Over 3 and 3.5 for Game"

"Holland - Eredivisie, Soccer

Vitesse Arnhem/PSV Eindhoven 23-October-2011 7:29 AM PST

Total Goals Over 3 for Game"

"Hannover 96 v Bayern Munich

(Time of First Card) Card before 32:00"

"Bayer Leverkusen v Schalke

(Asian Total Corners) Over 9.5"

Saturday, October 22, 2011

Rich people across the world agree that the solution to every problem is more suffering for poor people.

DOPED racing horses wind up in food | Lokeren economy crushed

ALL RED LOSER DAY

"Belgium - Pro League, Soccer

Lokeren 22-October-2011 8:59 AM PST L

Handicap +1 for Game"

"Belgium - Pro League, Soccer

Lierse/Sint-Truidense 22-October-2011 10:59 AM PST L

Total Goals Over 2.5 for Game"

"Germany - Bundesliga, Soccer

Hertha BSC Berlin/FSV Mainz 05 22-October-2011 6:30 AM PST L

Total Goals Over 2.5 for Game"

"Germany - Bundesliga, Soccer

TSG Hoffenheim/Borussia Mönchengladbach 22-October-2011 6:30 AM PST L

Total Goals Over 2.5 for Game"

"Germany - Bundesliga, Soccer

Home Teams (Saturday 6 Matches)/Away Teams (Saturday 6 Matches) 22-October-2011 6:30 AM PST

Total Goals Over 17 for Game" L

"Holland - Eredivisie, Soccer

VVV Venlo/RKC Waalwijk 22-October-2011 9:44 AM PST W

Total Goals Over 2.5 and 3 for Game"

"Holland - Eredivisie, Soccer

Excelsior SBV/Heracles Almelo 22-October-2011 10:44 AM PST L

Total Goals Over 3 for Game"

"France - Ligue 1, Soccer

Nancy/Nice 22-October-2011 9:59 AM PST L

Total Goals Over 2 for Game"

"France - Ligue 1, Soccer

Home Teams (Saturday 7 Matches)/Away Teams (Saturday 7 Matches) 22-October-2011 9:59 AM PST

Total Goals Over 16.5 for Game" L

American kidball Saturday

loser again

"NCAA, American Football

Illinois 22-October-2011 9:00 AM PST L

Handicap -3.5 for Game"

"NCAA, American Football

Maryland 22-October-2011 12:30 PM PST L

Handicap +18 for Game"

"NCAA, American Football

Duke 22-October-2011 9:30 AM PST W

Handicap +3.5 for Game"

"NCAA, American Football

Cincinnati U 22-October-2011 9:00 AM PST W

Handicap +3 for Game"

"NCAA, American Football

Texas A&M 22-October-2011 12:30 PM PST L

Handicap -20.5 for Game"

"NCAA, American Football

TCU 22-October-2011 11:00 AM PST W

Handicap -43.5 for Game"

"NCAA, American Football

Nebraska 22-October-2011 12:30 PM PST W

Handicap -24.5 for Game"

"NCAA, American Football

Northwestern 22-October-2011 4:00 PM PST L

Handicap +4.5 for Game"

"NCAA, American Football

Florida Atlantic 22-October-2011 5:00 PM PST L

Handicap +6 for Game"

"NCAA, American Football

North Texas 22-October-2011 2:00 PM PST W

Handicap +6 for Game"

Friday, October 21, 2011

Crap friday night kidball picks

1-1 loser

"NCAA, American Football

Rutgers 21-October-2011 5:00 PM PST L

Handicap -1 for Game"

They pulled to 16-14 with 14:10 left after driving 80 yards over 14 plays when Nova tossed a 12-yard TD pass to Mohamed Sanu. That was as close as they would get as Mark Harrison dropped a would-be touchdown with the nearest defender 10 yards away, and Rutgers wound up punting on fourth-and-1 with 7:06 left.

"NCAA, American Football

Syracuse 21-October-2011 5:00 PM PST W

Handicap +14 for Game"

Thursday night kid ball, Lucked Out!

"NCAA, American Football

UAB 20-October-2011 5:00 PM PST W

Handicap +16.5 for Game"

"NCAA, American Football

Arizona U 20-October-2011 6:00 PM PST W

Handicap -5.5 for Game"

Thursday, October 20, 2011

Most Foreclosure Sales From Previous 5 Years Are VOID

---

BOMBSHELL - Massachusetts Supreme Court Rules That Most Foreclosure Sales From Previous 5 Years Are VOID

On Oct. 18th, 2011 the Massachusetts Supreme Judicial Court handed down their decision in the FRANCIS J. BEVILACQUA, THIRD vs. PABLO RODRIGUEZ – and in a moment, essentially made foreclosure sales in the commonwealth over the last five years wholly void. However, some of the more polite headlines, undoubtedly in the interest of not causing wide spread panic simply put it "SJC puts foreclosure sales in doubt" or "Buyer Can't Sue After Bad Foreclosure Sale."

In essence, the ruling upheld that those who had purchased foreclosure properties that had been illegally foreclosed upon (which is virtually all foreclosure sales in the last five years), did not in fact have title to those properties. Given the fact that more than two-thirds of all real estate transactions in the last five years have also been foreclosed properties, this creates a small problem.

The Massachusetts SJC is one of the most respected high courts in the country, other supreme courts look to these decisions for guidance, and would find it difficult to rule any other way in their own states. It is a precedent. It's an important precedent.

Here are the key components of the Bevilacqua case:

Wednesday, October 19, 2011

Here is what the Wall Street Occupation is all about:

if you don't comment no angel will gets its wings... 0Tuesday, October 18, 2011

they fail to see who is behind every scene!!!

so they will never unite and attack us!!!

"In modern industry ... capital, which force we represent, is [at] the apex. Both management and labor are on the base of this triangle.

The Zionist Billionaires Who Control Politics

February 23, 2011

[Updated from Sept 2010, by request](Libertarian sugar daddy, David Koch)

Douglas Reed: "The plan, I think, is the old one of world dominion in a new form. The money-power and revolutionary power have been set up and given sham but symbolic shapes ('Capitalism' or 'Communism') and sharply defined citadels ('America' or 'Russia'). Such is the spectacle publicly staged for the masses. But what if similar men, with a common aim, secretly rule in both camps and propose to achieve their ambition through the clash between those masses? I believe any diligent student of our times will discover that this is the case."

by Henry Makow Ph.D.

Bloomberg News has a story today on how the Zionist Koch brothers bankrolled the campaigns of Governors (like Scott Walker) who are cutting union powers. Whether we agree with this policy or not, this shows how these billionaires continue to define the political discourse in left-right terms when they should be defined as people versus Illuminati left and right.

According to the article by Jane Mayer, the Koch's bankroll a plethora of Libertarian and "right-wing" lobbies, think tanks and foundations, which in turn fund and direct the "grass roots" Tea Party movement.

"The anti-government fervor infusing the 2010 elections represents a political triumph for the Kochs," she writes. "By giving money to "educate," finance, and organize Tea Party protesters, they have helped turn their private agenda into a mass movement."

Mayer neglects to mention that the Koch's are Jews or crypto Jews; instead she tries to give them a "goy gloss."

Patriarch Fred Koch, a founding member of the John Birch Society, was a "real John Wayne type." He was the son of a "Dutch" printer who emphasized "rugged pursuits.' He took his four sons "big game hunting in Africa" and made them do "farm labor at the family ranch."

Surprising then to learn that Fred and his sons are on lists of Jewish billionaires, and "free-enterprise-Fred" made his fortune building refineries for the genocidal Communist dictator Josef Stalin in the 1930's.

Liberals whinge about these nefarious "red necks" who oppose Obamacare and climate change, and lobby for less taxes and government interference. But that's not the real story here.

(Sam Newhouse)

The real story is that Jane Meyer works for another Illuminati Jewish billionaire, publisher Sam Newhouse. Her job is to create the illusion of free democratic discourse. Between the Sam Newhouses and George Soros' on the Left, and the Koch's and the Rupert Murdochs on the Right, a dozen Illuminati (Masonic) Jewish billionaires are able to define political discourse in America.

So while we're busy arguing about government intervention, we ignore the long list of things these billionaires apparently agree on: Israel, 9-11, the war on terror, the wars in Iraq and Afghanistan, the Federal Reserve, trillion dollar bank bailouts, liberal immigration policy and "equal rights" for gays and lesbians, i.e. undermining marriage and family by promoting homosexual norms. You can bet they also secretly agree on world government.

This is why nothing important changes. This is why crack dealer and bathhouse boy Barack Obama is our President. Why the conservative alternative is Wasilla AK Mayor Sarah Palin. The Billionaires of Zion are laughing up their sleeves at the goyim.

THE KOCH EMPIRE

Koch Industries is the second-largest private company in America after Cargill. "With an annual revenue of $100 billion, the company was just $6.3 billion shy of first place in 2008. Ownership is kept strictly in the family, with the company being split roughly between brothers Charles and David Koch, who are worth about $20 billion apiece...Today, it operates thousands of miles of pipelines in the United States, refines 800,000 barrels of crude oil daily, buys and sells the most asphalt in the nation, is among the top 10 cattle producers, and is among the 50 largest landowners."

According to the New Yorker, "the company has grown spectacularly since their father, Fred, died, in 1967, and the brothers took charge. The company expanded at an unreal rate: its revenues increased from $100 million in 1966 to $100 billion in 2008--that's 1,000-fold growth. The Koch's operate oil refineries in Alaska, Texas, and Minnesota, and control some four thousand miles of pipeline. Koch Industries owns Brawny paper towels, Dixie cups, Georgia-Pacific lumber, Stainmaster carpet, and Lycra, among other products."

According to researcher Yasha Levine, part of this growth was fueled by corruption: "William Koch, the third brother who had a falling-out with Charles and David back in the '80s over Charles' sociopathic management style, appeared on "60 Minutes" in November 2000 to tell the world that Koch Industries was a criminal enterprise: "It was - was my family company. I was out of it," he says. "But that's what appalled me so much... I did not want my family, my legacy, my father's legacy to be based upon organized crime."

"Charles Koch's racket was very simple," explained William. "With its extensive oil pipe network, Koch Industries' role as an oil middleman--it buys crude from someone's well and sells it to a refinery--makes it easy to steal millions of dollars worth of oil by skimming just a little off the top of each transaction, or what they call "cheating measurements" in the oil trade. According to William, wells located on federal and Native American lands were the prime targets of the Koch scam."

http://www.scribd.com/doc/30006881/Koch-Steal-From-Indians

It is estimated they stole $230 million.

http://www.truthdig.com/report/item/tea_party_financiers_owe_their_fortune_to_joseph_stalin_20100418/

FRED KOCH AND THE JOHN BIRCH SOCIETY

Rich Illuminati Jews and Masons not only created Communism in Russia; they created anti-Communism in the USA.

Fred Koch (1900-1967) was a chemical engineer who invented a new process for refining oil. Supposedly, he was shut out of the US by the Rockefellers and had to go to work for Stalin. He built many refineries in Soviet Russia and trained Russian engineers to operate them. Supposedly, he became disillusioned with Communism and became a founding member of the John Birch Society in the 1950's.

The trouble is that according to the 1964-65, Edition of Who's Who, this militant anti-Communist was still building refineries in Russia and Eastern Europe. Moreover, the John Birch society was founded by members of the Council on Foreign Relations, many of whom were Masons, and staffed by former Communist writers.

For example, the founder Robert Welch had been a member of the Communist front "League for Industrial Democracy." William Grede, for many years Chairman of the Executive Council of the JBS was a Fed banker. Robert Love, member of the Governing Council was a 32nd Degree Mason. William Macmillan was a member of the CFR. Writers Eugene Lyons and Harold Varney used to work for the Communist "Workers World." (Helen Peters, "Is the JBS Subversive?" July 1970)

Ralph Epperson was on their speaker's bureau. But they expelled him from the JBS when he mentioned Freemasonry in one of his speeches somewhere. The JBS strongly does not want Freemasonry mentioned.

According to Eustace Mullins, the founder Robert Welch was a 32nd Degree Mason.

Evidently, the same treatment applies to Zionism, which is part of the Masonic fraternity.

POLITICS IS A CHARADE

Illuminati insider Harold Rosenthal explained how they pit labor (Left) versus management (Right):

"In modern industry ... capital, which force we represent, is [at] the apex. Both management and labor are on the base of this triangle. They continually stand opposed to each other and their attention is never directed to the head of their problem."

"At first, by controlling the banking system we were able to control corporation capital. Through this, we acquired total monopoly of the movie industry, the radio networks and the newly developing television media. The printing industry, newspapers, periodicals and technical journals had already fallen into our hands. The richest plum was later to come when we took over the publication of all school materials. Through these vehicles we could mold public opinion to suit our own purposes. The people are only stupid pigs that grunt and squeal the chants we give them, whether they be truth or lies."

Thus the Illuminati have a monopoly over our minds. By controlling both Left and Right, education and the mass media, the Masonic Jewish billionaires ensure that the masses are tractable. As the late great Alan Stang warned, the Tea Party is a psy-op meant to channel the Patriot Movement into the Left VS Right matrix.

Politics is like a House League in sports. The different teams all are Masons or are beholden to them. Thus, there's little chance of democratic change. Anyone who wants to play must abide by the "rules."

It's amusing to see "progressives" rail against the Tea Party and their sponsors. They are as much billionaire puppets as the rednecks they condemn.

The Illuminati Jewish billionaires have used "anti-Semitism" to give themselves immunity from criticism. However, they are responsible for anti-Semitism and for the suffering of their fellow Jews. Therefore, they don't deserve such consideration.

--

Related: Congress Rejects Goldstone Report (Condemning Israel)

Koch Money in Wisconsin

http://www.commondreams.org/headline/2011/02/22

9/11/11: Orgy of Deception

We must live our lives as constructively as possible, grateful for the freedom and prosperity we still enjoy. We mustn't be depressed by the human condition. Eventually the Illuminati will self-destruct. Evil is inherently dysfunctional. ..."

The World Central Bank:

Other Western Élites

The World Central Bank:  The Bank for International Settlements

The Bank for International Settlements

Address: The Tower of Basel - Centralbahnplatz 2, 4051, Basel, Switzerland

http://www.bis.org/about/baselmap.htm

This page is the fruit of research for the UK Green Party's economics group for their 2001 mini-conference in Manchester.

The BIS is the most obscure arm of the Bretton-Woods International Financial architecture but its role is central. John Maynard Keynes wanted it closed down as it was used to launder money for the Nazis in World War II. Run by an inner elite representing the world's major central banks it controls most of the transferable money in the world. It uses that money to draw national governments into debt for the IMF.

BIS Official Website http://www.bis.org/

The Bretton Woods Project http://www.brettonwoodsproject.org/

WALL STREET AND THE RISE OF HITLER. By Antony C. Sutton http://reformed-theology.org/html/books/wall_street/index.html

05Aug03 - Rich Jannsen - Bank watching in Basel

The BIS - Ruling the World of Money - Edward Jay Epstein

Carrol Quigley quote - the bankers' plan

The Network - Alfred Mendez

Global Financial Institutions - Mark Evans

Board of Directors - July 2001

1983 - Trading With The Enemy - A Bank for All Reasons

Unraveling the Basel Capital Accord

Antony Sutton - B.I.S. — The Apex of Control

05Aug03 - Bank watching in Basel

05Aug03 - Bank watching in Basel

All pictures on this page are by Richard Janssen

I was on business-travel from city to city in Switzerland. After the work in Basel I went straight to the BIS to see the buildings in real life.

In Basel, I noticed that there are two BIS-buildings, about a kilometer from eachother. The 'Botta'-building at the Aeschenplatz is a former UBS-bank. It has a door with the ABN-Amro-bank next door, very strange. ABN-Amro has a indoor connection with BIS, I saw it with my own two eyes!

After that I went to Geneva via Evian. Evian-les-Bains in France was also a place worth to visit.

I didn't dare to take pictures of some particular buildings, because through my remarkable behavior in Basel I was followed by Securitas people everywhere I went. There was no place in Switzerland where I had to introduce myself, because Securitas already knew me in advance.

Of course I have been at 'Place des Nations', where all the global organisations are based. Also I've been in the most-shattered bank in Geneva: the UBS-headquarters, it was full of nasty punchholes in the glass windows because of the quite recent demonstrations. Swiss people were really flabbergasted, because such demonstration of hooligans at the anti-globalists demonstrations are new to them.

Everywhere I went, I was protected by Securitas. 'Big Bro Securitas' was watching me all the time. I enjoyed every minute of it, because of the predictable manners of Securitas-employees. Also in Bern I was heavily protected by Securitas.

Back in Basel I went into the BIS building at the Central Station Place to try to open a bank-account. At that moment there was a press-conference going on, how strange. The Securitas-guy in front of the building recognized me, so he didn't ask a thing and let me go to do what I want to do. I asked the receptionist to open a bank account, but he lied to me that BIS is a private-bank.

After that I went to the Aeschenplatz and went in. The receptionist told me frankly that the B.I.S. "IS NOT A BANK". Thanks, lady receptionist, that was exactly what I wanted to hear, that BIS is not a bank. Now it is confirmed by this BIS-employee!

Ruling the World of Money

Ruling the World of Money

Convenient formats for printing this article

Ruling the World of Money in Rich Text Format

Ruling the World of Money as a Word Document

by Edward Jay Epstein -1983 Harpers Magazine

reprinted from Monetary Reform Magazine - Canada

website: http://www.monetary-reform.on.ca/main.shtml

email: editor@monetary-reform.on.ca

TEN TIMES A YEAR - once a month except in August and October - a small group of well dressed men arrives in Basel, Switzerland. Carrying overnight bags and attaché cases, they discreetly check into the Euler Hotel, across from the railroad station. They have come to this sleepy city from places as disparate as Tokyo, London, and Washington, D.C., for the regular meeting of the most exclusive, secretive, and powerful supranational club in the world.

Each of the dozen or so visiting members has his own office at the club, with secure telephone lines to his home country. The members are fully serviced by a permanent staff of about 300, including chauffeurs, chefs, guards, messengers, translators, stenographers, secretaries, and researchers. Also at their disposal are a brilliant research unit and an ultramodern computer, as well as a secluded country club with tennis courts and a swimming pool, a few kilometres outside of Basel.

The membership of this club is restricted to a handful of powerful men who determine daily the interest rate, the availability of credit, and the money supply of the banks in their own countries. They include the governors of the U.S. Federal Reserve, the Bank of England, the Bank of Japan, the Swiss National Bank, and the German Bundesbank. The club controls a bank with a $40 billion kitty in cash, government securities, and gold that constitutes about one tenth of the world's available foreign exchange. The profits earned just from renting out its hoard of gold (second only to that of Fort Knox in value) are more than sufficient to pay for the expenses of the entire organization. And the unabashed purpose of its elite monthly meetings is to coordinate and, if possible, to control all monetary activities in the industrialized world. The place where this club meets in Basel is a unique financial institution called the Bank for International Settlements - or more simply, and appropriately, the BIS (pronounced "biz" in German).

THE BIS was originally established in May 1930 by bankers and diplomats of Europe and the United States to collect and disburse Germany's World War I reparation payments (hence its name). It was truly an extraordinary arrangement. Although the BIS was organized as a commercial bank with publicly held shares, its immunity from government interference - and taxes in both peace and war was guaranteed by an international treaty signed in The Hague in 1930. Although all its depositors are central banks, the BIS has made a profit on every transaction. And because it has been highly profitable, it has required no subsidy or aid from any government.

THE BIS was originally established in May 1930 by bankers and diplomats of Europe and the United States to collect and disburse Germany's World War I reparation payments (hence its name). It was truly an extraordinary arrangement. Although the BIS was organized as a commercial bank with publicly held shares, its immunity from government interference - and taxes in both peace and war was guaranteed by an international treaty signed in The Hague in 1930. Although all its depositors are central banks, the BIS has made a profit on every transaction. And because it has been highly profitable, it has required no subsidy or aid from any government.

Since it also provided, in Basel, a safe and convenient repository for the gold holdings of the European central banks, it quickly evolved into the bank for central banks. As the world depression deepened in the Thirties and financial panics flared up in Austria, Hungary, Yugoslavia, and Germany, the governors in charge of the key central banks feared that the entire global financial system would collapse unless they could closely coordinate their rescue efforts. The obvious meeting spot for this desperately needed coordination was the BIS, where they regularly went anyway to arrange gold swaps and war-damage settlements.

Even though an isolationist Congress officially refused to allow the U.S. Federal Reserve to participate in the BIS, or to accept shares in it (which were instead held in trust by the First National City Bank), the chairman of the Fed quietly slipped over to Basel for important meetings. World monetary policy was evidently too important to leave to national politicians. During World War II, when the nations, if not their central banks, were belligerents, the BIS continued operating in Basel, though the monthly meetings were temporarily suspended. In 1944, following Czech accusations that the BIS was laundering gold that the Nazis had stolen from occupied Europe, the American government backed a resolution at the Bretton Woods Conference calling for the liquidation of the BIS. The naive idea was that the settlement and monetary-clearing functions it provided could be taken over by the new International Monetary Fund. What could not be replaced, however, was what existed behind the mask of an international clearing house: a supranational organization for setting and implementing global monetary strategy, which could not be accomplished by a democratic, United Nations-like international agency. The central bankers, not about to let their club be taken from them, quietly snuffed out the American resolution.

After World War II, the BIS reemerged as the main clearing house for European currencies and, behind the scenes, the favored meeting place of central bankers. When the dollar came under attack in the 1960s, massive swaps of money and gold were arranged at the BIS for the defence of the American currency. It was undeniably ironic that, as the president of the BIS observed, "the United States, which had wanted to kill the BIS, suddenly finds it indispensable." In any case, the Fed has become a leading member of the club, with either Chairman Paul Volcker or Governor Henry Wallich attending every "Basel weekend."

"It was in the wood-paneled rooms above the shop and the hotel that decisions were reached to devalue or defend currencies, to fix the price of gold, to regulate offshore banking, and to raise or lower short-term interest rates."

ORIGINALLY, the central bankers sought complete anonymity for their activities. Their headquarters were in an abandoned six-storey hotel, the Grand et Savoy Hotel Universe, with an annex above the adjacent Frey's Chocolate Shop. There purposely was no sign over the door identifying the BIS so visiting central bankers and gold dealers used Frey's, which is across the street from the railroad station, as a convenient landmark. It was in the wood-paneled rooms above the shop and the hotel that decisions were reached to devalue or defend currencies, to fix the price of gold, to regulate offshore banking, and to raise or lower short-term interest rates. And though they shaped "a new world economic order" through these deliberations (as Guido Carli, then the governor of the Italian central bank, put it), the public, even in Basel, remained almost totally unaware of the club and its activities.

ORIGINALLY, the central bankers sought complete anonymity for their activities. Their headquarters were in an abandoned six-storey hotel, the Grand et Savoy Hotel Universe, with an annex above the adjacent Frey's Chocolate Shop. There purposely was no sign over the door identifying the BIS so visiting central bankers and gold dealers used Frey's, which is across the street from the railroad station, as a convenient landmark. It was in the wood-paneled rooms above the shop and the hotel that decisions were reached to devalue or defend currencies, to fix the price of gold, to regulate offshore banking, and to raise or lower short-term interest rates. And though they shaped "a new world economic order" through these deliberations (as Guido Carli, then the governor of the Italian central bank, put it), the public, even in Basel, remained almost totally unaware of the club and its activities.

In May 1977, however, the BIS gave up its anonymity, against the better judgement of some of its members, in exchange for more efficient headquarters. The new building, an eighteen-story-high circular skyscraper that rises over the medieval city like some misplaced nuclear reactor, quickly became known as the "Tower of Basel" and began attracting attention from tourists. "That was the last thing we wanted, " Dr. Fritz Leutwiler, current president of both the BIS and the Swiss National Bank, explained to me while watching currency changes flash across the Reuters screen in his office. "If it had been up to me, it never would have been built."

Despite its irksome visibility, the new headquarters does have the advantages of luxurious space and Swiss efficiency. The building is completely air-conditioned and self-contained, with its own nuclear-bomb shelter in the sub-basement, a triply redundant fire-extinguishing system (so outside firemen never have to be called in), a private hospital, and some twenty miles of subterranean archives. "We try to provide a complete clubhouse for central bankers ... a home away from home," said Gunther Schleiminger, the super-competent general manager, as he arranged a rare tour of the headquarters for me.

Despite its irksome visibility, the new headquarters does have the advantages of luxurious space and Swiss efficiency. The building is completely air-conditioned and self-contained, with its own nuclear-bomb shelter in the sub-basement, a triply redundant fire-extinguishing system (so outside firemen never have to be called in), a private hospital, and some twenty miles of subterranean archives. "We try to provide a complete clubhouse for central bankers ... a home away from home," said Gunther Schleiminger, the super-competent general manager, as he arranged a rare tour of the headquarters for me.

The top floor, with a panoramic view of three countries - Germany, France, and Switzerland - is a deluxe restaurant, used only to serve the members a buffet dinner when they arrive on Sunday evenings to begin the "Basel weekends." Aside from those ten occasions, this floor remains ghostly empty.

On the floor below, Schleiminger and his small staff sit in spacious offices, administering the day-to-day details of the BIS and monitoring activities on lower floors as if they were running an out-of-season hotel.

The next three floors down are suites of offices reserved for the central bankers. All are decorated in three colors - beige, brown, and tan - and each has a similar modernistic lithograph over the desk. Each office also has coded speed-dial telephones that at a push of a button directly connect the club members to their offices in their central banks back home. The completely deserted corridors and empty offices - with nameplates on the doors and freshly sharpened pencils in cups and neat stacks of incoming papers on the desks - are again reminiscent of a ghost town. When the members arrive for their forthcoming meeting in November, there will be a remarkable transformation, according to Schleiminger, with multilingual receptionists and secretaries at every desk, and constant meetings and briefings.

On the lower floors are the BIS computer, which is directly linked to the computers of the member central banks, and provides instantaneous access to data about the global monetary situation, and the actual bank, where eighteen traders, mainly from England and Switzerland, continually roll over short-term loans on the Eurodollar markets and guard against foreign-exchange losses (by simultaneously selling the currency in which the loan is due). On yet another floor, gold traders are constantly on the telephone arranging loans of the bank's gold to international arbitragers, thus allowing central banks to make interest on gold deposits.

Occasionally there is an extraordinary situation, such as the decision to sell gold for the Soviet Union, which requires a decision from the "governors," as the BIS staff calls the central bankers. But most of the banking is routine, computerized, and riskless. Indeed, the BIS is prohibited by its statutes from making anything but short-term loans - most are for thirty days or less - that are government-guaranteed or backed with gold deposited at the BIS. The profits the BIS receives for essentially turning over the billions of dollars deposited by the central banks amounted to $162 million last year.

AS SKILLED as the BIS may be at all this, the central banks themselves have highly competent staff capable of investing their deposits. The German Bundesbank, for example, has a superb international trading department and 15,000 employees - at least twenty times as many as the BIS staff. Why then do the Bundesbank and the other central banks transfer some $40 billion of deposits to the BIS and thereby permit it to make such a profit?

One answer is, of course, secrecy. By commingling part of their reserves in what amounts to a gigantic mutual fund of short-term investments, the central banks create a convenient screen behind which they can hide their own deposits and withdrawals in financial centers around the world. For example, if the BIS places funds in Hungary, the individual central banks do not have to answer to their governments for investing in a communist country. And the central banks are apparently willing to pay a high fee to use the cloak of the BIS.

There is, however, a far more important reason why the central banks regularly transfer deposits to the BIS: they want to provide it with a large profit to support the other services it provides. Despite its name, the BIS is far more.than a bank. From the outside, it seems to be a small, technical organization. Just eighty-six of its 298 employees are ranked as professional staff. But the BIS is not a monolithic institution: artfully concealed within the shell of an international bank, like a series of Chinese boxes one inside another, are the real groups and services the central bankers need -- and pay to support.

The first box inside the bank is the board of directors, drawn from the eight European central banks (England, Switzerland, Germany, Italy, France, Belgium, Sweden, and the Netherlands), which meets on the Tuesday morning of each "Basel weekend." The board also meets twice a year in Basel with the central banks of Yugoslavia, Poland, Hungary, and other Eastern bloc nations. It provides a formal apparatus for dealing with European governments and international bureaucracies like the IMF or the European Economic Community (the Common Market). The board defines the rules and territories of the central banks with the goal of preventing governments from meddling in their purview. For example, a few years ago, when the Organization for Economic Cooperation and Development in Paris appointed a low-level committee to study the adequacy of bank reserves, the central bankers regarded it as poaching on their monetary turf and turned to the BIS board for assistance. The board then arranged for a high-level committee, under the head of Banking Supervision at the Bank of England, to preempt the issue. The OECD got the message and abandoned its effort.

To deal with the world at large, there is another Chinese box called the Group of Ten, or simply the "G-10." It actually has eleven full-time members, representing the eight European central banks, the U.S. Fed, the Bank of Canada, and the Bank of Japan. it also has one unofficial member: the governor of the Saudi Arabian Monetary Authority. This powerful group, which controls most of the transferable money in the world, meets for long sessions on the Monday afternoon of the "Basel weekend." It is here that broader policy issues, such as interest rates, money-supply growth, economic stimulation (or suppression) , and currency rates are discussed - if not always resolved.

Directly under the G-10, and catering to all its special needs, is a small unit called the "Monetary and Economic Development Department," which is, in effect, its private think tank. The head of this unit, the Belgian economist Alexandre Lamfalussy, sits in on all the G-10 meetings, then assigns the appropriate research and analysis to the half dozen economists on his staff. This unit also produces the occasional blue-bound "economic papers" that provide central bankers from Singapore to Rio de Janeiro, even though they are not BIS members, with a convenient party line. For example, a recent paper called "Rules versus Discretion: An Essay on Monetary Policy in an Inflationary Environment," politely defused the Milton Friedmanesque dogma and suggested a more pragmatic form of monetarism. And last May, just before the Williamsburg summit conference, the unit released a blue book on currency intervention by central banks that laid down the boundaries and circumstances for such actions. When there are internal disagreements, these blue books can express positions sharply contrary to those held by some BIS members, but generally they reflect a consensus of the G-10.

OVER A BRATWURST-AND-BEER lunch on the top floor of the Bundesbank, which is located in a huge concrete building (called "the bunker") outside of Frankfurt, Karl Otto Pöhl, its president and a ranking governor of the BIS, complained to me about the repetitiousness of the meetings during the "Basel weekend." "First there is the meeting on the Gold Pool, then, after lunch, the same faces show up at the G-10, and the next day there is the board [which excludes the U.S., Japan, and Canada], and the European Community meeting [which excludes Sweden and Switzerland from the previous group]." He concluded: "They are long and strenuous - and they are not where the real business gets done." This occurs, as Pöhl explained over our leisurely lunch, at still another level of the BIS: "a sort of inner club," as he put it.

The inner club is made up of the half dozen or so powerful central bankers who find themselves more or less in the same monetary boat: along with Pöhl are Volcker and Wallich from the Fed, Leutwiler from the Swiss National Bank, Lamberto Dini of the Bank of Italy, Haruo Mayekawa of the Bank of Japan, and the retired governor of the Bank of England, Lord Gordon Richardson (who had presided over the G -10 meetings for the past ten years). They are all comfortable speaking English; indeed, Pöhl recounted how he has found himself using English with Leutwiler, though both are of course native German-speakers. And they all speak the same language when it comes to governments, having shared similar experiences. Pöhl and Volcker were both undersecretaries of their respective treasuries; they worked closely with each other, and with Lord Richardson, in the futile attempts to defend the dollar and the pound in the 1960s. Dini was at the IMF in Washington, dealing with many of the same problems. Pöhl had worked closely with Leutwiler in neighboring Switzerland for two decades. "Some of us are very old friends," Pöhl said. Far more important, these men all share the same set of well-articulated values about money.

The prime value, which also seems to demarcate the inner club from the rest of the BIS members, is the firm belief that central banks should act independently of their home governments. This is an easy position for Leutwiler to hold, since the Swiss National Bank is privately owned (the only central bank that is not government owned) and completely autonomous. ("I don't think many people know the name of the president of Switzerland - even in Switzerland," Pöhl joked, "but everyone in Europe has heard of Leutwiler.") Almost as independent is the Bundesbank; as its president, Pöhl is not required to consult with government officials or to answer the questions of Parliament - even about such critical issues as raising interest rates. He even refuses to fly to Basel in a government plane, preferring instead to drive in his Mercedes limousine.

The Fed is only a shade less independent than the Bundesbank: Volcker is expected to make periodic visits to Congress and at least to take calls from the White House - but he need not follow their counsel. While in theory the Bank of Italy is under government control, in practice it is an elite institution that acts autonomously and often resists the government. (In 1979, its then governor, Paolo Baffi, was threatened with arrest, but the inner club, using unofficial channels, rallied to his support.) Although the exact relationship between the Bank of Japan and the Japanese government purposely remains inscrutable, even to the BIS governors, its chairman, Mayekawa, at least espouses the principle of autonomy. Finally, though the Bank of England is under the thumb of the British government, Lord Richardson was accepted by the inner club because of his personal adherence to this defining principle. But his successor, Robin Leigh-Pemberton, lacking the years of business and personal contact, probably won't be admitted to the inner circle.

In any case, the line is drawn at the Bank of England. The Bank of France is seen as a puppet of the French government; to a lesser degree, the remaining European banks are also perceived by the inner club as extensions of their respective governments, and thus remain on the outside.

A second and closely related belief of the inner club is that politicians should not be trusted to decide the fate of the international monetary system. When Leutwiler became president of the BIS in 1982, he insisted that no government official be allowed to visit during a "Basel weekend." He recalled that in 1968, U.S. Treasury undersecretary Fred Deming had been in Basel and stopped in at the bank. "When word got around that an American Treasury official was at the BIS," Leutwiler said, "bullion traders, speculating that the U.S. was about to sell its gold, began a panic in the market." Except for the annual meeting in June (called " the Jamboree" by the staff), when the ground floor of the BIS headquarters is open to official visitors, Leutwiler has tried to enforce his rule strictly. "To be frank," he told me, "I have no use for politicians. They lack the judgement of central bankers." This effectively sums up the common antipathy of the inner club toward "government muddling," as Pöhl puts it.

The inner-club members also share a strong preference for pragmatism and flexibility over any ideology, whether that of Lord Keynes or Milton Friedman. For this reason, there was considerable apprehension last spring that Paul Volcker would be replaced by a supply-side ideologue like Beryl Sprinkel, and considerable relief when he was reappointed for another term. Rather than resorting to rhetoric and invoking principles, the inner club seeks any remedy that will relieve a crisis. For example, earlier this year, when Brazil failed to pay back on time a BIS loan that was guaranteed by the central banks, the inner club quietly decided to extend the deadline instead of collecting the money from guarantors. "We are constantly engaged in a balancing act - without a safety net," Leutwiler explained.

THE FINAL AND by far the most important belief of the inner club is the conviction that when the bell tolls for any single central bank it tolls for them all. When Mexico faced bankruptcy last year, for instance, the issue for the inner club was not the welfare of that country but, as Dini put it, "the stability of the entire banking system." For months Mexico had been borrowing overnight funds from the interbank market in New York - as every bank recognized by the Fed is permitted to do - to pay the interest on its $80 billion external debt. Each night it had to borrow more money to repay the interest on the previous nights transactions, and, according to Dini, by August Mexico had borrowed nearly one quarter of all the "Fed Funds," as these overnight loans between banks are called.

The Fed was caught in a dilemma: if it suddenly stepped in and forbade Mexico from further using the interbank market, Mexico would be unable to repay its enormous debt the next day, and 25 percent of the entire banking system's ready funds might be frozen. But if the Fed permitted Mexico to continue borrowing in New York, in a matter of months it would suck in most of the interbank funds, forcing the Fed to expand drastically the supply of money.

It was clearly an emergency for the inner club. After speaking to Miguel Mancera, director of the Banco de Mexico, Volcker immediately called Leutwiler, who was vacationing in the Swiss mountain village of Grison. Leutwiler realized that the entire system was confronted by a financial time bomb: even though the IMF was prepared to extend $4.5 billion to Mexico to relieve the pressure on its long-term debt, it would require months of paperwork to get approval for the loan. And Mexico needed an immediate fix of $1.85 billion to get out of the interbank market, which Mancera had agreed to do. But in less than forty-eight hours, Leutwiler had called the members of the inner club and arranged the temporary bridging loan.

While this $1.85 billion appeared - at least in the financial press - to have come from the BIS, virtually all the funds came from the central banks in the inner club. Half came directly from the United States - $600 million from the Treasury's exchange-equalization fund and $325 million from the Fed's coffers; the remaining $925 million mainly from the deposits of the Bundesbank, Swiss National Bank, Bank of England, Bank of Italy, and Bank of Japan, deposits that were specifically guaranteed by these central banks, though advanced pro forma by the BIS (with a token amount advanced by the BIS itself against the collateral of Mexican gold). The BIS undertook virtually no risk in this rescue operation; it merely provided a convenient cloak for the inner club. Otherwise, its members, especially Volcker, would have had to take the political heat individually for what appeared to be the rescue of an underdeveloped country. In fact, they were - true to their paramount values - rescuing the banking system itself.

On August 31 of this year, Mexico repaid the BIS loan. But the bailout was only a temporary, if not pyrrhic, victory. With the multibillion-dollar debts of a score of other countries - including Argentina, Chile, Venezuela, Brazil, Zaire, the Philippines, Poland, Yugoslavia, Hungary, and even Israel - hanging like so many swords of Damocles over its sacred monetary system, the inner club has "no choice," as Leutwiler has concluded, but to remain a crisis manager. This new role has created considerable concern among the outer circle, and even in the Bank of England, since the members who don't entirely share the mentality of the inner club want the BIS to remain primarily a European institution. "Let the Fed worry about Brazil and the rest of Latin America - that is not the job of the BIS," a blunt representative of the Bank of England, definitely not part of the inner club, told me. Others at the BIS have argued that it does not have the experience or facilities to become "a mini-IMF - putting out fires around the world," as one staffer described it.

To mollify such dissent on the periphery, inner club members publicly pay lip service to the ideal of preserving the character of the BIS and not turning it into a lender of last resort for the world at large. Privately, however, they will undoubtedly continue their maneuvers to protect the banking system at whatever point in the world it seems most vulnerable. After all, it is ultimately the central banks' money at risk, not the BIS's. And the inner club will also keep using the BIS as its public mask - and pay the requisite price for the disguise.

The next meeting of the inner club is Monday, November 7.....

Edward Jay Epstein is the author of The Rise and Fall of Diamonds, Legend: The Secret World of Lee Harvey Oswald, and News From Nowhere. He also has written a book on international deception.

UPDATE (9 years later) -

Investor's Business Daily, May 1, 1992 summed up the character of the BIS in an article entitled:

Why a Global Credit Crunch? Some say Little-known BIS Is Partly to Blame - Despite its global anonymity, the BIS is one of the most powerful financial institutions in the world ...

In the book Global Financial Integration: the End of Geography, author Richard F. O'Brien further confirms the powerful role of the BIS:

In the financial marketplace, the trend towards some sort of global governance is best represented by the efforts of bank supervisors under the aegis of the Bank for International Settlements in Basel to impose common minimum capital requirements on banks ... and to integrate and coordinate the supervision of banking, securities markets and insurance ...

Financial World Magazine - February 16, 1993 "Where Has All the Money Gone?" explains how the BIS has more recently flexed its muscle:

Even before Japan's equity markets began to contract, regulations put into effect in 1988 by the Bank of International Settlement's Committee on Banking regulation and Supervisory Practices had begun to exact a particularly heavy toll on Japanese lenders. Those regulations require the world's bankers to raise their underlying asset bases, the money against which they lend, to 8% to total capital, more than double the asset average of the 1980's.- J Epstein

Carrol Quigley - the bankers' plan

Carrol Quigley - the bankers' plan

"The Power of financial capitalism had [a] far reaching plan, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole.This system was to be controlled in a feudalistic fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences.

The apex of the system was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world's central banks, which were themselves private corporations.

Each central bank sought to dominate its government by its ability to control treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence co-operative politicians by subsequent rewards in the business world."

Carrol Quigley, Tragedy and Hope, 1966 - [Bill Clinton's mentor and Georgetown University professor]

THE NETWORK

THE NETWORK

Alfred Mendez -

See also Alfred Mendez' article AN UNCOMMON VIEW OF THE BIRTH OF AN UNCOMMON MARKET on my Bilderberg History page

See also Alfred Mendez' article AN UNCOMMON VIEW OF THE BIRTH OF AN UNCOMMON MARKET on my Bilderberg History page

http://www.spectrezine.org

The wealth of the country flees the land

Like cottonseed on a wind

Blown by the fetid breath

Of money-pimps in Bedlam

Pursuing the creed of masters

Who worship a market freed

Of all restraints on greed -

While politicians posture

And feed on delusions of power

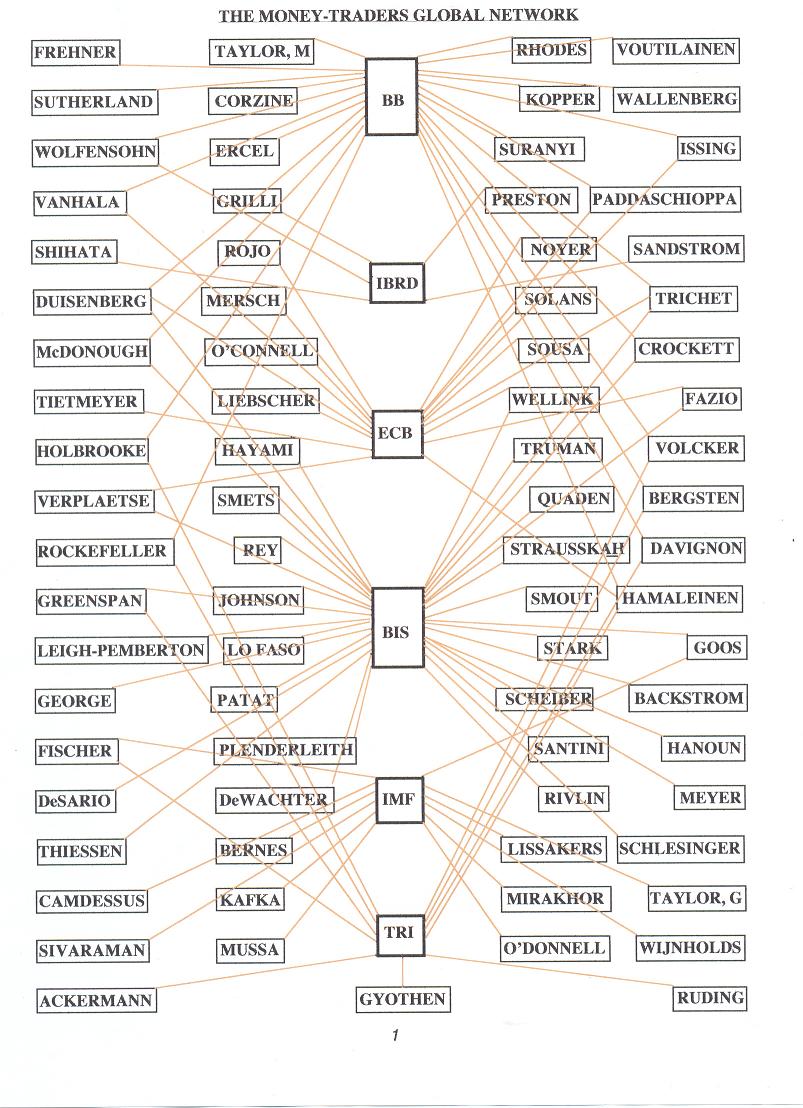

The above graph [couldn't reproduce it here, see below ed.] was created in order to bestow meaning in simplistic, delineated form to such terms as 'free market', 'new world order' and 'globalisation' - terms that have dominated political/economic terminology over the past two decades-or-so, and the fact that it focusses on banks and bankers (a profession endowed with the aura of authority in the eyes of the public) is quite simply because, without money, those terms are meaningless. Indeed, the title itself emphasises the role of money: After all, what is a banker if he's not a trader in money? Similarly, 'globalisation' would be equally meaningless if such politically omnipotent groups as the Bilderberg Group and the Trilateral Commission were not taken into account when assessing it's (globalisation's) significance. Moreover, how is it possible to disassociate banker from politician from businessman when, at times, one individual is all three - and, in any case, they are constituent parts of a single entity: the corporate establishment? Hence the inclusion of these two groups withinthe graph.

The Bilderberg (or BB from now on) was formed in 1954 out of the need of corporate America to ensure cohesion of purpose on the part of its European partners in the recently formed North Atlantic Alliance (NATO) - the twin aim being to facilitate the flow of American capital into the region, and to bring Germany into the Alliance (against, it should be noted, the wishes of many of its partners). That it is a group endowed with enormous political clout can be attested to by: (1) examination of the lists of committee members and conference attendees over the years - together with the gravity and importance of the subjects discussed at these conferences (NATO, understandably, being repeatedly a key subject); and (2) these conferences take place under very strict security cover supplied by the respective host countries - even though implicit within the structure of this cabal is its unaccountable, secretive nature.

The Trilateral Commission (or TRI from now on) was formed in 1973, its agenda determined by the corporate-funded Brookings Institute and the Kettering Foundation - with not-a-little-help from David Rockefeller of the Chase/Manhattan Bank. That its projected formation should have been so enthusiastically acclaimed by the BB Conference in Knokke (Belgium) in 1972 should cause no surprise. Both corporate-controlled organisations, with linked membership, they shared the same aim: increasing globalisation of their wealth and power. Certainly, the BB with its total lack of any 'democratic accountability', must be in agreement with the TRI's declaration (published in their "The crisis of Democracy") that what the West needs most "is a greater degree of moderation in democracy". Though, on second thoughts, the former probably thinks the 'the degree of moderation' somewht understated!

A further examination of both graph and list of bankers' names reveals that, of the banking organisations, the Banks for International Settlements (or BIS from now on) is self-evidently of prime importance on the international scene - not only because of its prestigious membership (embracing as it does the head bankers of the leading industrial nations) - but also because of the significance of its links with other groups. This article will focus on it, at the expense of the other better-known banking institutions, for two reasons: (1) its prime ranking in the international hierarchy; and (2) so little knowledge of it is in the public domain.

The BIS is the world's oldest international financial institution, having been set up in 1930 with the twin aim of (1) coping with reparations/loans from/to a very unstable post-World War one Germany; and (2) more importantly, to act as a forum for central bankers in the future. As such, it was the epitome of supranationality - able to circumvent all those orthodox ideals that had, over the years, become synonymous with the concept of the 'nation state' - such as 'love of country', 'patriotism' etc., - the danger, of course, being that, in certain circumstances (such as a state of war), such circumvention of patriotism by any of its board members could lead to them being accused of treasonable offences.

In order to appreciate what followed, it is essential to offer a brief resumé of the political/economic situation at the turn of the century: the Industrial Revolution, having fostered the rapid growth of a capitalist economy, inevitably gave birth to an ideal/dogma exposing the socio-political discord inherent within that same system which was based on the concept of one comparatively small group of people garnering profit from the wealth created by the labor of a much larger group. Thus was Marxism born - leading to the Bolshevik revolution in 1917.The USSR, now perceived by the industrial nations as representing the very antithesis of capitalism, was henceforth 'the enemy'. The 'cold war' had begun, and its most blatant expression was the birth of fascism in the aftermath of the Bolshevik revolution - a birth both induced and nurtured by corporations such as I.G.Farben, SKF, Ford, ITT and Du Pont - corporation which were fast becoming multi-national in nature..Enter BIS. Set up in 1930 (see above),it consisted, initially, of a group of 6 central banks and a 'financial institution of the USA'. Granted a constitution charter by Switzerland, it was henceforth based in that country. That America was by then a financial force to be reckoned with on the international scene is borne out by the fact that the first President appointed to the BIS was Gates W. McGarrah (ex-Chase National Bank & Federal Reserve Bank).

By the late 1930's the BIS had assumed an openly pro-Nazi bias - much of it disclosed by Charles Higham in his book "Trading With the Enemy", and years later corroborated by a BBC Timewatch film "Banking With Hitler" (broadcast in late '98). Two examples of such bias (there were many more) were: (1) The BIS had arranged transfers into the account of the German's Reichbank of $378 million of what was, in effect, gold looted from the coffers of the invaded countries of Austria, Czechoslovakia, Holland and Belgium; and (2) in the summer of 1942, plans for the projected American invasion of Algeria were leaked to the governor of the French National Bank, who immediately contacted his German colleague in the BIS, SS Gruppenfuehrer Baron Kurt von Schroder (of the Stein Bank of Cologne), and by transferring 9 billion gold francs to Algiers - via the BIS - the Germans and their French subsidiaries made a killing of some $175 million in this dollar-exchange scam. Given the membership of the BIS at that time, this was hardly surprising. On the board were the following high-profile representatives of the Axis powers (there were 4 others): Walther Funk (Pres. of the Reichbank); Kurt von Schroder (above); Dr. Hermann Schmitz (Jt.Chm. of I.G.Farben); Emil Puhl (V/Pres. of the Reichbank); Yoneji Yamamoto; and Dr. V. Azzolini (Gov. Bank of Italy). It should be added that, of the non-Axis members on the board, many - such as Montagu Norman (Gov. of the Bank of England) were Nazi sympathisers, and that the President of the BIS from 1939 to 1946 was Thomas McKittrick, an American corporate lawyer who had been both Director of Lee, Higginson & Co. (a company which had made substantial loans to the Third Reich) and Chairman of the British-American Chamber of Commerce in London. His continued presidency of the BIS after America's entry into the war in December1941 was approved by Germany and Italy with this significant addendum to their note of authorisation: "McKittrick's opinions are safely known to us".

With the above noted disclosures in mind, the policy of appeasement pursued by Britain and France towards Germany in the pre-war period can now be more readily understood. By concluding a pact with Hitler, Britain and France - in effect - gave him the green light to advance eastwards (ref. "Mein Kampf"). Furthermore, the fact that they shared his endemic anti-communism blinded them to the risk that they were running by negotiating from a position of comparative military weakness - of which Hitler was perfectly aware - and for which they paid a heavy price. It should also be added that the architect of this act of appeasement, Prime Minister Chamberlain, was a shareholder in ICI, which had ties with I.G.Farben.

In the late '30's, and more particularly during World War 2, given America's great wealth - as opposed to Europe's straitened circumstances - it was inevitable that the trade between the two would be of a one-way nature, from the former to the latter. And not surprisingly, in view of the close relationship between American and German corporations (as noted above), a substantial portion of supplies went to Germany - often via fascist Spain - by ship and tanker under flags of neutrality. Many of the financial arrangements covering such trade were handled by BIS in neutral Basle. As an example of how substantial this trade was: in mid-'44 Am,erica was supplying Germany with 48 thousand tons of oil, and 11 hundred tons of much-needed wolfram (tungsten) per month! The fact that this trade was illegal in the USA for much of this period - and particularly after America's entry into the war in December '41 - did little to stop such trade. The large corporations, such as Standard Oil and ITT, saw to that. After all, then - as now - the US Administration was effectively under corporate control (as it has been since 1933, during FDR's term of office). Even the Secretary of Treasury, Henry Morgenthau, and his Assistant, Harry Dexter White, aware as they well were of the part played by BIS in this, could do little about it. In July '44, 730 delegates from 44 countries met at Bretton Woods to plan a framework for post-war international trade, payments and investments - a conference which subsequently resulted in the setting up in'47 of both the International Bank for Reconstruction & Development (IBRD, or World Bank) and the International Monetary Fund (IMF). The apparent inviolability of the BIS referred to above was perhaps best illustrated by the fact that Resolution 5, calling for the dissolution of BIS, was subsequently ignored and proven ineffective. The corporate establishment had seen to that - as indeed, it had seen to all such previous attempts.

With war's end now calling for a clearing of conscience, BIS's method of achieving this was by stressing its somewhat euphemistic neutrality, while playing down its less palatable, but quintessential supranationality. Their annual report of 1946 - as quoted in the Times - stated: "It is noted that the Bank has continued to supply the principles of strict neutrality, but that circumstances have caused a further decline in the volume of its business". Further: "Wars are the worst cause of monetary convulsions, and the first condition for enjoying the benefits of an ordinary monetary system is to establish and maintain a reign of peace". In view of their recent previous history, the term 'irony' hardly does justice to the above statements!. This report was, incidentally, the last to be signed by its President, Thomas McKittrick: in June 1946 he was appointedVice/Chairman of the Chase National Bank by its owners, the Rockefellers - presumably as a mark of gratitude for the assistance rendered to them by the BIS during his presidency.

In view of the somewhat puzzling fact that this now meant that there were in this post-war period three international financial/banking institutions - all with the self-evidently similar aim of resolving the world's serious economic problems - a brief, close look is called for in order to clarify the situation. The first (and intriguing) fact to be noted here is that, whereas the IMF and The World Bank have been frequently and conspicuously in the public eye from birth, the BIS has adopted a low profile and remained uncommunicative. This was an expedient tactic for the latter to adopt - for two reasons: (1) it thus eluded any investigation into its previous financial dealings with the Third Reich; and (2) more importantly, by so diassociating itself from the IMF and World Bank, the latter would henceforth be widely (though erroneously) regarded as the sole guardians of the worldwide economy, thus allowing the BIS more latitude to follow the agenda set by the corporate establishment - to whom, it must be recalled, they owed their survival.

This ambivalent relationship between the IMF/World Bank vis-a-vis the BIS/commercial banks in the 70's is epitomised by Anthony Sampson in his book "The Money Lenders": "The commercial banks in the meantime had created a very different perspective, for the IMF now controlled much less of the world's money. In 1966, the quotas which made up its capital amounted to 10% of the total world imports; but by '76 they made up only 4%"..."by '76 world annual deficits had reached $75 billion : of this, 7% financed by the IMF; 18% by other official international bodies (governments and World Bank) - remaining three-quarters financed by banks (commercial)". (Today, some two-and-a-half decades later, the board members of BIS, between them, control 95% of the money in circulation). The reason for this apparent taking over of such responsibility by the BIS from the IMF/World Bank is twofold: (1) the collapse of the Bretton Woods system of exchange convertibility in the early seventies exposed the irrelevance of the latter as agents for European reconstruction; and (2) the latter being statutorily-appointed agents of the UN, were therefore - ostensibly - accountable to a much wider constituency than the BIS, and therefore politically less manageable by the corporate establishment, whose primary aim in the aftermath of World War 2 was to ensure the unrestricted flow of American capital into Europe. A flow considerably eased by subsequent European integration, in which both NATO and the Bilderberg played a crucial role. This aim was furthered by means of the US Congressionally-authorised European Cooperation Act (ECA) of 1948, and implemented by its subsidiary, the European Payments Union (EPU) of 1950 - both under the aegis of the Marshall Plan of 1947. Predictably, the BIS was the institution chosen by the EPU to oversee this movement of capital (a point worthy of note here is that the head of the EPU at that time was one Richard Bissell, an economist who, years later, was to be the CIA Deputy Director of Planning overseeing the Bay of Pigs fiasco in April '61!).The BIS was now firmly ensconced in the heart of European integration, and was subsequently to play a critical role in the events leading to its (Europe's) eventual evolvement into the European Union, a bureaucratic politico-economic body occupying a position of crucial importance within the wider global hierarchy envisaged by the corporate establishment.